News

Read Our Latest Posts

New Distribution Codes for Form 1099R

September 6, 2024

What is Form 1099R? The 1099-R, issued to individuals, reports retirement income to the IRS that they receive from a qualified retirement plan, such as a 401K, IRA or pension plan. It also reports the taxable portion of those benefits along with any taxes withheld. The IRS requires that payments be identified by ... New Distribution Codes for Form 1099R

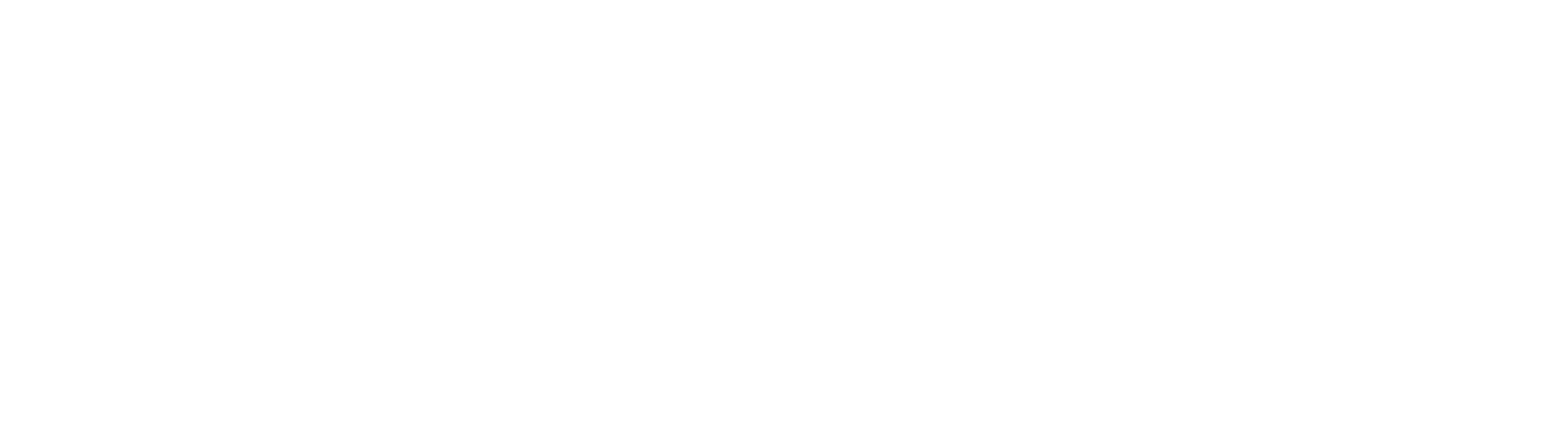

1099-NEC Joins Combined Federal State Filing Program TY2021

October 18, 2021

During the 2020 tax year, the Internal Revenue Service (IRS) added Form 1099-NEC: Nonemployee Compensation. The form is now in its second year since its re-introduction, and the government agency is including it in the Combined Federal State Filing Program (CF/SF). Making Filing Easier Recently, the IRS released Publication 1220 confirming that it has included ... 1099-NEC Joins Combined Federal State Filing Program TY2021

Scam Targeting University Students and Staff

April 5, 2021

University students and staff should be aware of IRS impersonation email scam People should be aware of an ongoing IRS-impersonation scam that appears to target educational institutions, including students and staff who have .edu email addresses. The suspect emails display the IRS logo and use various subject lines, such as Tax Refund Payment or Recalculation ... Scam Targeting University Students and Staff

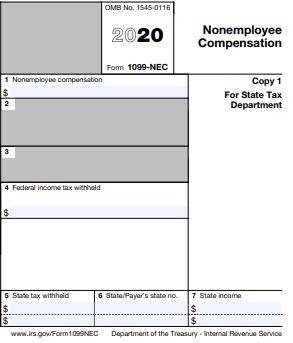

1099-NEC State Reporting Requirements TY2020

December 15, 2020

The 1099-NEC will not be part of the IRS Combined Federal State Filing Program for TY2020. If you have an obligation to report 1099-NEC directly to states, you should follow the instructions below when formatting your 1099-NEC file: Populate Box 5 State tax withheld if there is an amount to report. Populate Box 6 State/Payer ... 1099-NEC State Reporting Requirements TY2020

Seven Best Practices as You Navigate 1098-T Files

December 3, 2020

This is a guest blog post, originally featured at Nelnet Campus Commerce: campuscommerce.com/seven-best-practices-as-you-navigate-1098t-files/ In Brief: Outline of seven essential tips to when navigating 1098-T files Highlight of common errors institutions experience while processing 1098-T’s and insights on what is a qualified payment Nelnet and the TAB Service Company have been partners for four years Best ... Seven Best Practices as You Navigate 1098-T Files

CARES Act and Funding for Students

August 19, 2020

How will Coronavirus stimulus benefit students? COVID-19 has impacted all sectors and industries, and education is no exception. On March 27, 2020, CARES, or Coronavirus Aid, Relief, and Economic Security Act, provided federal stimulus aid to the Department of Education to supplement institutions and students with COVID-19 pandemic related expenses and financial needs related to ... CARES Act and Funding for Students

Pressure Seal 101

August 15, 2018

You may not be familiar with what pressure seal forms are but, the chances are that you have come into contact with them before. Most often pressure sealed forms are used to print and mail tax documents, checks, grade reports, invoices or financial statements. They have been the go-to option for high-volume mailers because they ... Pressure Seal 101

What you need to know about GDPR

May 14, 2018

Chances are likely that you have heard the acronym GDPR in recent news headlines. But, what exactly is this regulation and how does it impact businesses outside of the European Union? The General Data Protection Regulation (GDPR) legislation was created back in April 2016 and is scheduled for implementation later this month (May 25th, 2018). ... What you need to know about GDPR

Affordable Care Act Penalties: Letter 226J

April 10, 2018

The Affordable Care Act (ACA) filings started in tax year 2015 and the reporting has been ongoing. The applicable large employers (ALE’s) that have been required to file the 1095/1094-C haven’t seen any penalties until recently. The penalty assessment notice from IRS is called 226J and it is sent to ALE’s who the IRS believe ... Affordable Care Act Penalties: Letter 226J

IRS Extends the Deadline to Furnish Forms 1095-C & 1095-B

November 18, 2016

Today on November 18, 2016 the IRS sent out Notice 2016-70 announcing the extension for furnishing information returns 1095-C and 1095-B to recipients. This will be the second year for mandated ACA reporting and the second year an extension has been granted. Last year the 2015 mailing deadline was extended from January 31st to March ... IRS Extends the Deadline to Furnish Forms 1095-C & 1095-B

Nelnet Partners with ts1098t

August 30, 2016

Nelnet Business Solutions, a leader in providing comprehensive campus commerce solutions which empower more than 750 higher education institutions, has announced a new partnership with Tab Service Company to develop an interface between Nelnet’s payment processing platforms and 1098-T processing services from Tab Service Company. “The ability to integrate campus payment history with the generation ... Nelnet Partners with ts1098t

ts1099 launches (ACA) Reporting & Compliance App

September 17, 2015

CHICAGO, Sept. 16, 2015 /PRNewswire/ — Tab Service Company has been a leader in 1099 tax form outsourcing services for decades. The tax form processing application TSC1099, is a complete cloud-based reporting and compliance solution. It enables businesses to upload data that is quickly processed, printed, mailed and e-filed at our service center each year. The ... ts1099 launches (ACA) Reporting & Compliance App