1099 E-Filing, Printing and Mailing Services

A complete 1099 cloud-based solution with an in-house production center staffed by experts.

Upload your data,

we do the rest

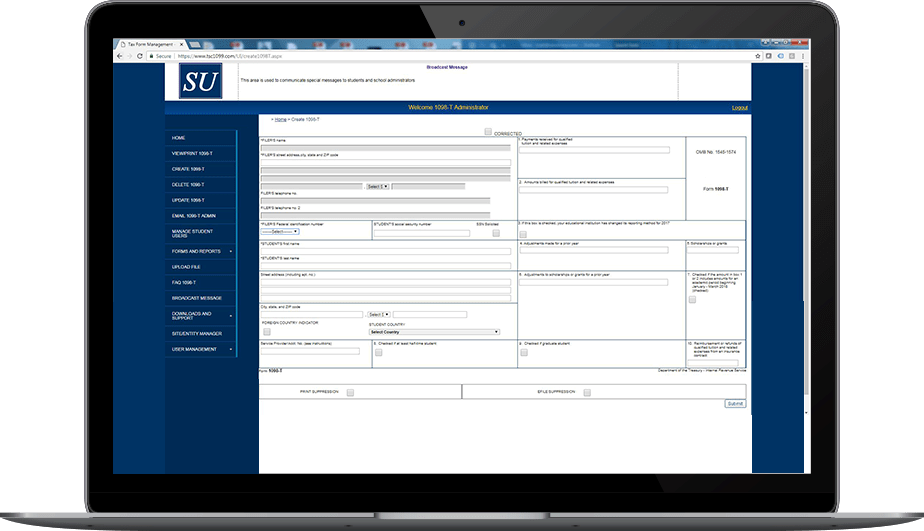

Our easy-to-use web platform accepts virtually any file format. Once uploaded, your data analyst will process your file, create your forms and notify you when ready for review.

Simply log in and review the summary report and mail proof. If there is any issue, we troubleshoot until you are ready to click "approved"!

We print, seal, mail and E-file your forms ourselves. Our entire organization is compliant with SOC2, so your data and forms are in good hands from start to finish.

You can create, delete or update forms and view/print from your desktop. Post-filing corrections are transmitted directly to the IRS at no additional cost.

Why Choose the ts1099 Platform?

- Complete web-based solution for 1099 and 1095 forms

- SOC2 audit ensures security, confidentiality, and processing integrity

- No expensive software to purchase, install and learn

- Always compliant with the latest tax rules and regulations

- U.S.-based, toll-free phone support

- Tax ID/name verification service reduces the risk of IRS penalties

- Printing and mailing services included

- Post-filing corrections transmitted directly to the IRS at no extra cost

- No licensing or subscription fees – the ts1099 platform is free for all our print and mail customers

Making the 1099 process less taxing

— Senior Accountant, Vacation Rental IndustryWe just completed our first 1099 filing with Tab Service Company. The client portal interface is secure and very easy to use. The initial upload was seamless, and corrections made throughout the process were instantly updated. The customer service was excellent.

— Head of Financial Systems, Clean Energy CompanyI can’t stress enough how much of a big win working with Tab Service Company has been. The deliverables are perfect and there have been no problems whatsoever. The team has saved us around 200–300 man-hours, making processing less strenuous on our own workforce.

YOUR TRUSTED 1099 PROCESSING SERVICE PROVIDER

COMPLETE FORM 1099 PREPARATION, PROCESSING, AND EFILING SERVICES

As a full 1099 service provider, ts1099 handles all your organization’s 1099 and 1095 reporting needs. Our cloud-based 1099 software is simple, secure, convenient and cost-effective.

Don’t piecemeal your 1099 processing. Let us take care of printing and mailing, IRS e-filing, TIN validation, corrections processing, and so much more.

Stay compliant and meet all IRS deadlines with our reliable outsourcing services. The best 1099 provider is the one you can count on.

Enhanced Functionality to Meet Our Clients’ Needs

The ts1099 platform has helped businesses outsource 1099 processing since 2005. It is created and powered by Tab Service Company, a data processing leader since 1960.

Our mission is to reduce your company’s burden of labor-hours dedicated to tax filing with our all-in-one 1099 filing service. That is why we are one of the top 1099 processing companies today.

The web-based software has an easy-to-use interface and rigorous security standards. Enhanced features include Single Sign-On authentication and API. The best part: no program to install and no subscription fees!

Enjoy a wide range of online 1099 preparation services that include:

- 1095 Affordable Care Act (ACA) reporting

- 1098-T reporting, distribution and e-presentment

- T4A Form processing

- 480 Form for Puerto Rico

- 1099-DA

- and many more forms you can view in list-form here

Contact us to learn more about a customized 1099 solution for your business. Find out why we are one of the leading 1099 processing service providers and get a quote today.